strategic visioning.

Pacific Life was undergoing a much needed but chaotic digital transformation. I was brought into the Life Insurance Division to assess and create the product improvements the department most needed to enhance the user experience.

As lead designer, I defined and led research, gathered stakeholder input, and created and presented a solution. During my information gathering phase it became clear to me that the pods within the Life Insurance division had been designing and building in silos, and there was a bigger opportunity than designing product improvements to enhance the existing experience.

The opportunity I seized was defining the future-state customer journey in a unified way across the division, so that all teams could align future work towards a consistent goal. I created a storyboard to assist stakeholders in easily sharing the journey, and to serve as a north star vision, ensuring future work remains aligned.

Timeline

8 weeks

Role

Lead Product Designer

Team

CX Director

CX Data Analyst

Sr Strategy Architect

the background.

Pacific Life is a B2B life insurance and retirement solutions company that sells products through financial advisors, who then sell to end clients. Our customers are these financial advisors, who range from independent sole proprietorships to Fortune 500 financial services firms.

the research.

My first step was to learn all I could about the current experience and determine the biggest pain points faced by both our employees and our customers. The directive given to me was to focus on the point in the experience where the financial advisor identifies a good candidate for life insurance, runs some quotes and presents the options to their client.

Currently, this is a costly, manual process where Pacific Life sales people (both field and internal wholesalers) help advisors identify potential clients, and Pacific Life case designers use our incredibly complicated quoting tool to run quotes for the advisors.

the people.

3

Internal wholesalers

3

Case Designers

4

Financial Advisors

I conducted qualitative interviews our customers, the financial advisors, as well as with the Pacific Life employees who use our products to help our customers, the wholesalers and the case designers.

Then I synthesized the results via affinity mapping to find themes and key insights.

the method.

opportunity identification.

My next goal was to identify opportunities for improvement. I go about this by mapping out the current state journey, including the pain points I found in the research, and then turning those current pain points into “how might we” opportunity statements.

To help me in this task I created some empathy tools, like personas and journey maps.

the personas.

the takeaways.

“I’m not a hand-holder. I’m always a do-it-first kind of person.”

Financial Advisor

World Financial Group

1

There is an openness and desire for financial advisors to do everything on their own, contradicting long-held beliefs that our customers only do business with us because they want our white-glove customer service.

2

There is a business cost directly related to complexity:

The complexity of our tools creates a high barrier to entry, only alleviated in manual, one-on-one, non-scalable ways.

The difficulty for advisors to understand the nuance in our products limits their ability to take advantage of them.

How might we create an easy-to-use experience that better educates our advisors and allows them to self-serve?

the user needs.

I worked with the CX Director to refine the customer journey into more distinct stages and identify the user needs and opportunities at each of those stages. When presenting it to the wider team I tied direct quotes from the interviews I had conducted to cement the truth behind these needs.

current state journey maps.

strategizing.

In brainstorming with the CX Director, we came up with two main future journeys:

1) The VIP path, which would look much like today (very high touch, white-glove service) for the 20% of our high-value producers who generate 80% of our revenue

2) The digital path, which would service the 80% of our customers who produce 20% our business, but currently follow our only customer journey, which is very manual.

visualizing the future.

future state ideation.

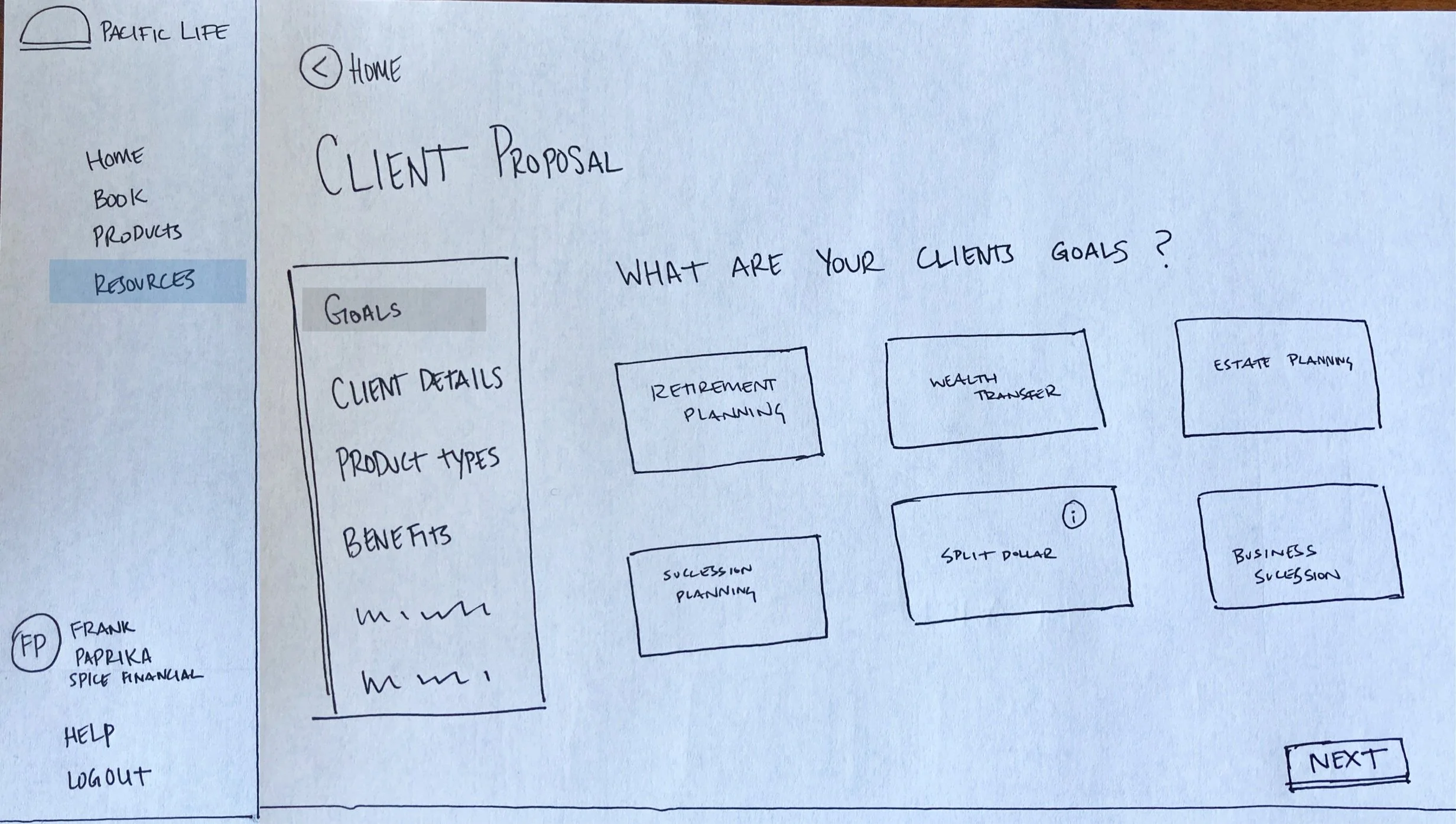

I took my analysis of the current state of the experience, combined with the insights we refined from the research and imagined what a future state might look like that addressed the needs of the financial adviser, Pacific Life employee and the business.

storyboarding.

In comes Jessica. I wanted to show how digitizing our processes doesn’t have to cause a reduction in customer service, but can actually meet our customers where they are, and how they expect. In addition, I wanted to humanize and visualize what it means to digitize our experience. Senior leadership talks about the need to be digital in order to be scalable, but what does that really mean?

What might a digital future look like?

How might we effectively share this concept with senior leadership?

The recently uncovered insight that financial advisors want to self-serve was controversial. When a company prides itself on great customer service, digital experiences can be seen as threatening, and change can be scary. We wanted to share our work and get SMEs and stakeholders on board, without inducing stress.

the asset.

the results.

We took Jessica’s Journey on a roadshow and were incredibly successful in helping senior leadership visualize a future state in a way that had never been done before. All strategy work and future prioritization is now being tied back to the stages in Jessica’s Journey.

More critically, I enlarged the reach of the customer experience office by shifting the perspectives of employees throughout the Life Insurance Division. What was a scattered effort to reduce business costs and please the customer (without learning their needs), is now a dedicated, guided effort to improve the experience for their financial professional, Jessica.

“Everyone’s talking about Jessica’s Journey!”